Offshore Company Formation: Browse International Waters Safely

Offshore Company Formation: Browse International Waters Safely

Blog Article

Unveiling the Advantages of Opting for Offshore Business Formation

Exploring the world of offshore firm development introduces a myriad of advantages that can considerably affect organizations and individuals alike. From tax obligation benefits to boosted property security, the appeal of offshore business development exists in its capacity to enhance financial methods and broaden international reach.

Tax Advantages

Additionally, overseas business can take part in tax preparation approaches that might not be offered in their residential nations, such as utilizing tax obligation treaties in between jurisdictions to lower withholding tax obligations on cross-border deals. This flexibility in tax obligation planning permits services to enhance their international procedures while managing their tax obligation exposure properly.

Additionally, offshore firms can gain from property security advantages, as properties held within these entities may be secured from certain lawful claims or financial institutions. This added layer of defense can secure business properties and preserve riches for future generations. Overall, the tax obligation advantages of developing an offshore business can supply services an one-upmanship in today's international marketplace.

Property Protection

Enhancing the security of service properties through critical planning is a main purpose of offshore business formation. Offshore entities offer a durable structure for safeguarding possessions from possible threats such as lawsuits, lenders, or political instability in residential territories. By establishing a business in a steady overseas territory with beneficial property protection individuals, laws and companies can protect their riches from numerous threats.

Among the key benefits of offshore firm development in regards to property defense is discretion. Several overseas territories supply rigorous personal privacy regulations that enable business to preserve anonymity regarding their ownership structure. offshore company formation. This discretion makes it testing for exterior celebrations to determine and target particular possessions held within the offshore entity

Furthermore, offshore structures often have provisions that make it hard for lenders to access properties held within these entities. Via lawful mechanisms like asset defense depends on or particular clauses in corporate records, individuals can include layers of security to protect their wealth from possible seizure.

Enhanced Personal Privacy

Additionally, several offshore jurisdictions do not need the disclosure of valuable owners or shareholders in public documents, including an added layer of privacy defense. This discretion can be specifically beneficial for high-profile people, entrepreneurs, and companies looking to stay clear of unwanted interest or shield sensitive financial information. Overall, the raised privacy used by overseas firm formation can supply satisfaction and a sense of safety for those aiming official site to keep their financial affairs safe and secure and discreet.

Global Market Gain Access To

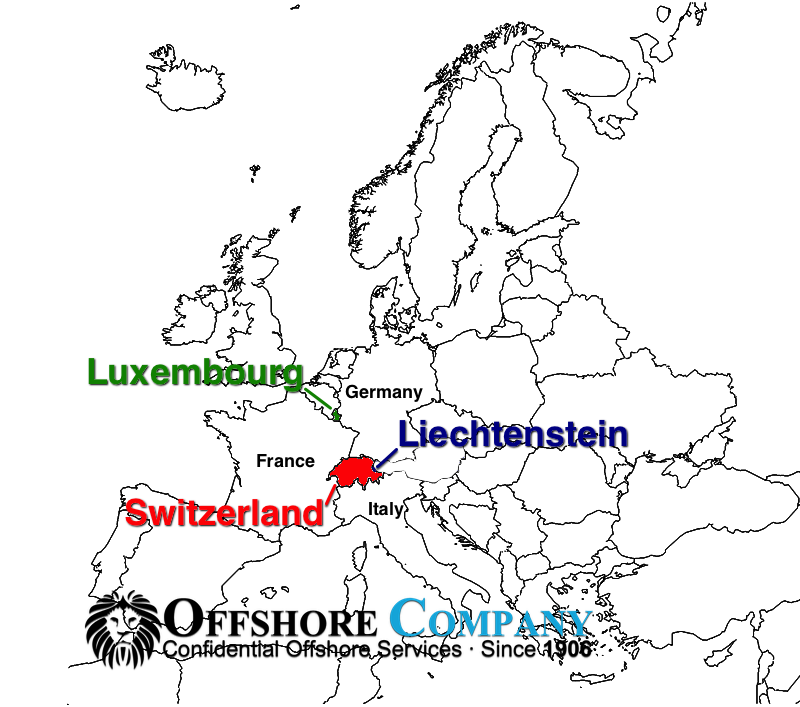

With the facility of an overseas firm, organizations gain the tactical advantage of tapping into worldwide markets with boosted convenience and performance. Offshore firm development gives firms with the possibility to access a broader customer base and explore new business prospects on a global range. By establishing procedures in overseas territories understood for their business-friendly guidelines and tax obligation rewards, business can broaden their reach beyond domestic borders.

International market accessibility via navigate to this site overseas business formation also enables businesses to develop global credibility and visibility. Running from a jurisdiction that is recognized for its stability and pro-business setting can improve the credibility of the company in the eyes of global companions, financiers, and customers. This raised credibility can open up doors to partnerships, collaborations, and possibilities that may not have been conveniently available through an only residential company approach.

In addition, offshore firms can profit from the diverse series of resources, abilities, and market insights available in various parts of the globe. By leveraging these global sources, companies can obtain a competitive side and stay in advance in today's interconnected and dynamic company landscape.

Lawful Compliance

Complying with legal conformity is crucial for offshore business to ensure governing adherence and risk reduction in their procedures. Offshore business have to navigate a complicated regulatory landscape, commonly based on both local regulations in the jurisdiction of consolidation and the global laws of the home nation. Failing to adhere to these lawful requirements can lead to extreme consequences, including penalties, lawsuits, or perhaps the retraction of the offshore business's certificate to operate.

To maintain lawful conformity, overseas firms generally involve lawful specialists with knowledge of both the regional guidelines in the overseas territory and the international legislations suitable to their procedures. These lawful professionals help in structuring the offshore firm in a fashion that makes certain conformity while taking full advantage of functional effectiveness and earnings within the bounds of the regulation.

Moreover, remaining abreast of advancing legal requirements is important for overseas firms to adapt their procedures as necessary. By focusing on legal compliance, overseas business can develop a strong structure for sustainable development and long-lasting success in the global market.

Conclusion

Finally, overseas company development supplies many advantages such as tax obligation advantages, property defense, boosted privacy, worldwide market access, and lawful compliance. These benefits make offshore companies an appealing option for businesses aiming to increase their operations internationally and optimize their economic methods. By benefiting from offshore firm formation, businesses can boost their affordable edge and position themselves for lasting success in the worldwide marketplace.

The facility of an offshore company can supply considerable tax obligation benefits for businesses looking for to enhance their economic frameworks. By setting up an overseas Your Domain Name company in a tax-efficient territory, companies can legally lessen their tax responsibilities and keep even more of their revenues.

On the whole, the tax benefits of establishing an overseas company can supply companies an affordable edge in today's international marketplace. offshore company formation.

Enhancing the protection of company properties through critical planning is a key objective of overseas firm formation. Offshore firm formation supplies firms with the opportunity to access a more comprehensive customer base and check out brand-new company leads on a global range.

Report this page